The Automotive Revolution

By James Soutter May 2016

The word disruption is verbosely thrown around when any new technology hits the street and promoters want to grab a sexy headline. That said the automotive industry is going through an upheaval not seen since the first affordable mass-made cars rolled off the Ford production line in 1908. We have come a long way since the Ford Model T; however the future of the car as we know it is more blurred than ever before.

Car manufacturers from Europe, Asia and the US are grappling with differing technologies, environmental considerations and consumer preferences, meaning that the divergence in automotive offerings that consumers will see over the next decade will be extensive and diverse.

The poster child of electric cars, Tesla, will want you to believe that Electric cars are the future, with other traditional manufacturers such as General Motors and BMW now allocating significant R&D spend to this area. However, hybrid cars (cars that use batteries and combustion engines) go a substantial way to meeting environmental regulations while their ease of use relative to pure electric cars cannot be overlooked.

However the debate doesn’t stop with the method of propulsion. Perhaps the more important threshold question is whether our children will actually drive a car? The era of the “autonomous car” is just around the corner and there is no shortage of companies lining up to be the first to bring an autonomous car to the mass market. The key is to firstly work out who these companies are, and then secondly which of these companies is likely to be the winner.

Car manufacturing is no longer confined to the large global brands consumers have identified with for a long period of time. New companies are consistently entering the market, some with significant balance sheets that will cause major disruption. One such example is Apple’s Project Titan which is currently testing autonomous vehicles with a goal to produce cars by 2020. Google is soon to commence building its own cars with a production target also in 2020. BMW has teamed up with the Chinese internet giant Baidu to gain access to Baidu’s mapping platform with testing currently underway outside Shanghai and Beijing. Mercedes in 2013 tested an autonomous car driving at 60 miles on a German Autobahn (speed unknown!) and has approval to test cars in California. Elon Musk, the founder of Tesla has stated publically that he expects driverless cars to be ready for consumers in the next five years.

K2 Asset Management sees both winners and losers during this period of hyper-accelerated change, new corporate partnerships are forming and those companies that do not invest and adapt will be left behind. Although it will be some time before the autonomous car becomes a commercial reality, the plug-in electric car is already upon us. Tesla is at the forefront of Electric cars with its battery technology possibly revolutionising the industry, however the company’s shares are currently trading on a 2016 P/E of 204x, and therefore, as George Michael said, “I gotta have faith”. Although we see Tesla being one of the key winners of this revolution, we also believe existing automotive companies such as General Motors, (which trades on only 5.5x 2016 P/E), with its Chevy Volt and Chevy Spark and BMW with its I-Series will continue to play a key role in the automotive market for a considerable time.

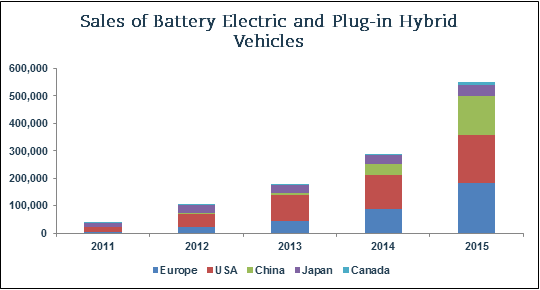

Electric car adoption is gaining pace, increasing by 70% from 2014 to 2015, with 550,000 vehicles sold worldwide. Although this figure in absolute terms is small relative to total global car sales of 74.3m in 2015, it is a trend that exhibits significant growth and continues to cause disruption to the broader automotive market. This trend was particularly noticeable on a recent research trip that emphasized the willingness of Parisians to embrace electric vehicles. Paris has over 720 charging locations with in excess of 5,500 charging points, highlighting the extensive impact electric cars have had.

Cars are constantly evolving and as both investors and consumers we must be able to adapt in order to gain benefit from this automotive revolution and not simply continue as a passenger.

Source: Bloomberg Data

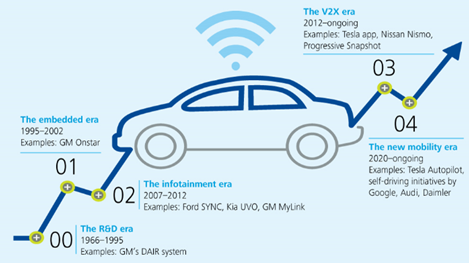

Source: Deloitte University Press

James Soutter is a Portfolio Manager at K2, specialising in international equities.

If you would like further information about the K2 International Strategies, please contact a member of our distribution team on 03 9691 6111 or visit www.k2am.com.

DISCLAIMER:

The information contained on this website is produced by K2 Asset Management Limited (K2) ABN 95 085 445 094, AFS Licence No 244393, a wholly owned subsidiary of K2 Asset Management Holdings Limited. Its contents are current to the date of the publication only and whilst all care has been taken in its preparation, K2 accepts no liability for errors or omissions. The application of its contents to specific situations (including case studies and projections) will depend upon each particular circumstance. The contents of this website have been prepared without taking into account the objectives or circumstances of any particular individual or entity and is intended for general information only.

Any opinions contained within this website are the author’s own and should not be considered the opinion of K2 or as advice.

Any K2 funds referenced on this website are issued by K2 unless otherwise stated. A product disclosure statement or information memorandum for the K2 funds referred to on this website can be obtained at www.k2am.com or by contacting K2. You should consider the product disclosure statement before making a decision to acquire an interest in a fund.

K2 does not accept any responsibility and disclaims any liability whatsoever for loss caused to any party by reliance on the information on this website. Please note that past performance is not a reliable indicator of future performance. Any advice and information contained on this website is general only and has been prepared without taking into account any particular circumstances and needs of any party. Before acting on any advice or information on this website you should assess and seek advice on whether it is appropriate for your needs, financial situation and investment objectives. Investment decisions should not be made upon the basis of its past performance or distribution rate, or any rating given by a ratings agency, since each of these can vary. In addition, ratings need to be understood in the context of the full report issued by the ratings agency themselves.

The content of this website is not to be reproduced without permission.